40 yield to maturity of coupon bond

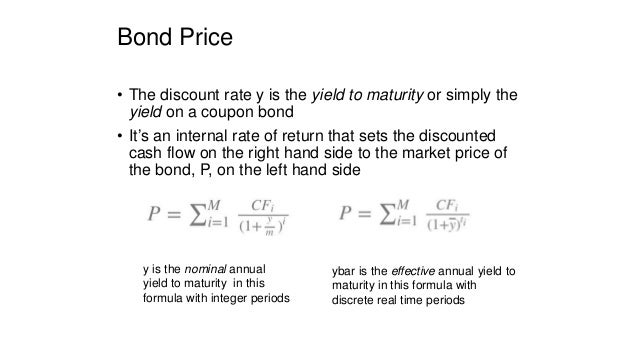

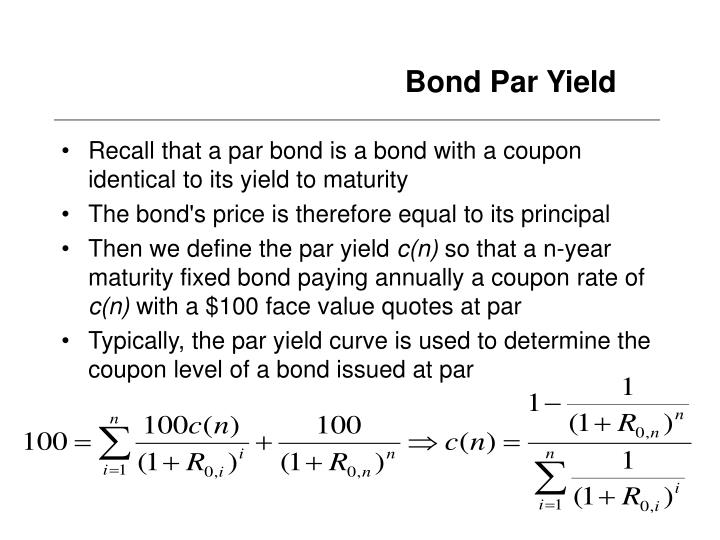

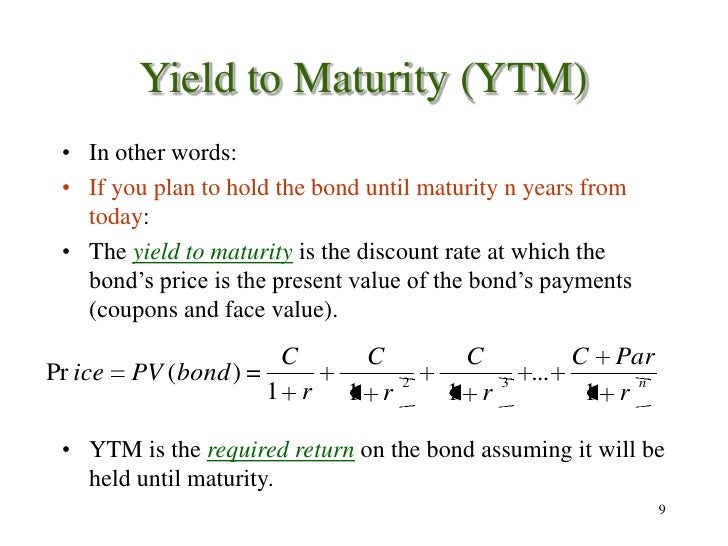

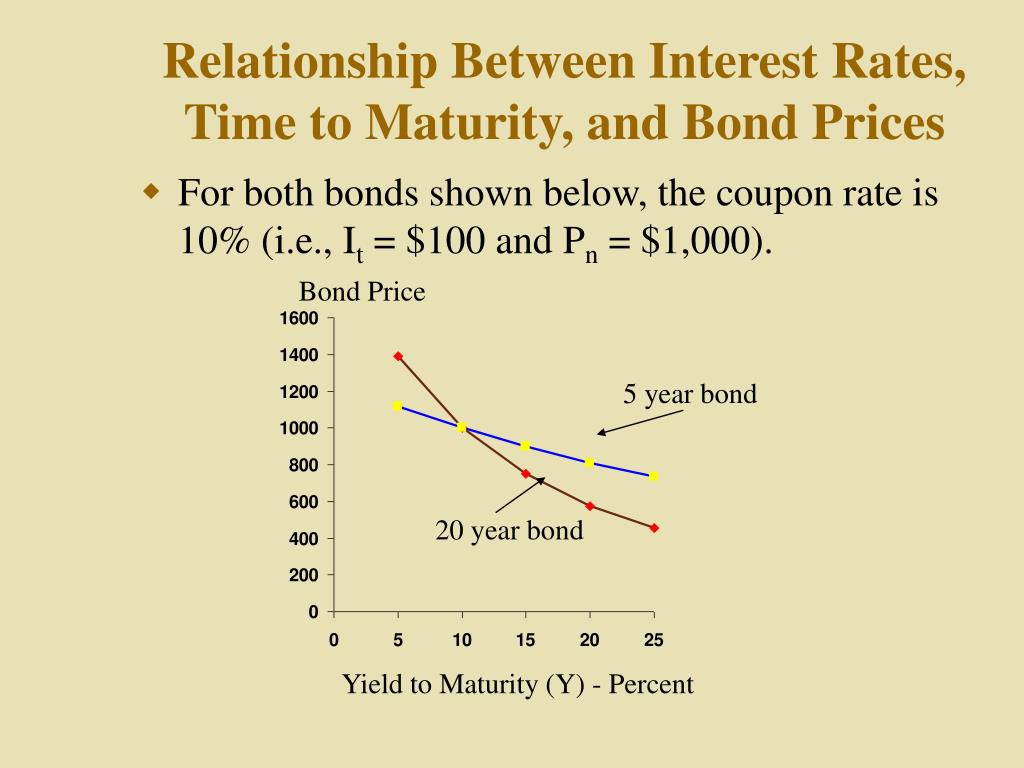

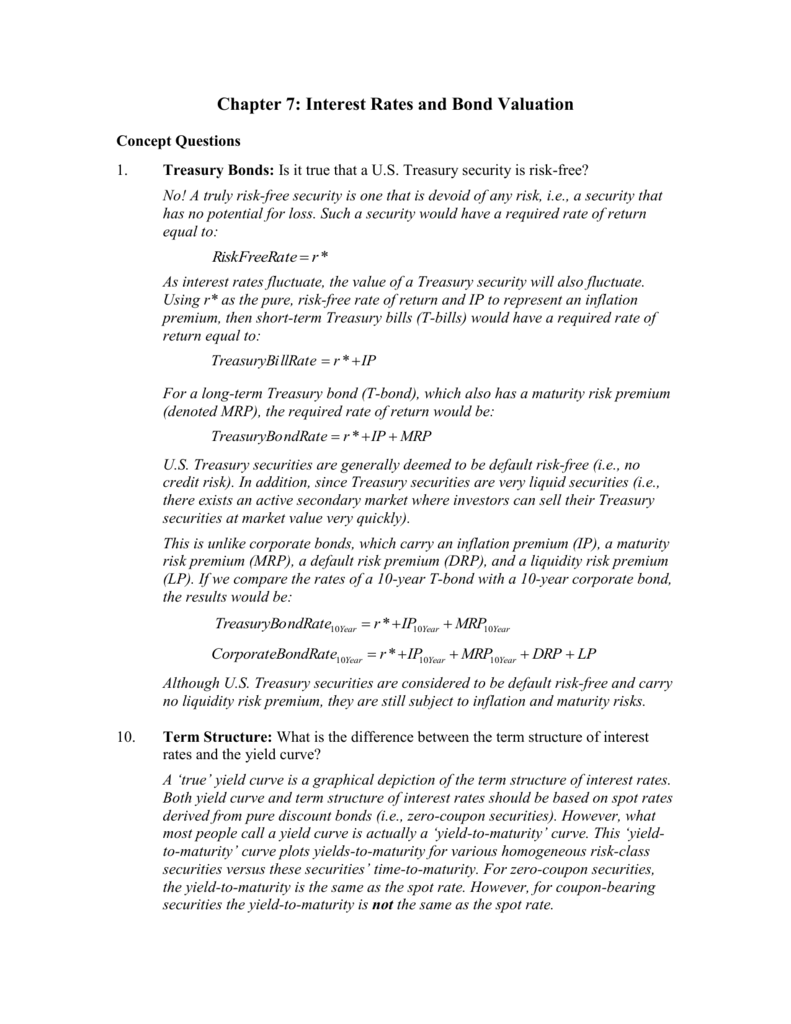

Solved Question 1 of 71 The yield to maturity on a coupon - Chegg Finance. Finance questions and answers. Question 1 of 71 The yield to maturity on a coupon bond is … · always greater than the coupon rate. · the rate an investor earns if she holds the bond to the maturity date, assuming she can reinvest all coupons at the current yield. · the rate an investor earns if she holds the bond to the maturity ... Yield to Maturity (YTM) - Wall Street Prep Yield to Maturity (YTM) and Coupon Rate / Current Yield If the YTM < Coupon Rate and Current Yield → The bond is being sold at a "premium" to its par value. If the YTM > Coupon Rate and Current Yield → The bond is being sold at a "discount" to its par value. If the YTM = Coupon Rate and Current Yield → The bond is said to be "trading at par".

Yield to Maturity | Formula, Examples, Conclusion, Calculator The most common formula used to calculate yield to maturity is: YTM = C + F−P/n / F+P/2 where: C = Coupon/interest payment F = Face value P = Price n = Years to maturity 3. Can yield to maturity be negative? Yes, yield to maturity can be negative if the price of the bond is higher than the face value.

Yield to maturity of coupon bond

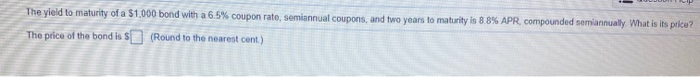

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value. Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond.

Yield to maturity of coupon bond. Important Differences Between Coupon and Yield to Maturity - The Balance Yield to maturity will be equal to coupon rate if an investor purchases the bond at par value (the original price). If you plan on buying a new-issue bond and holding it to maturity, you only need to pay attention to the coupon rate. If you bought a bond at a discount, however, the yield to maturity will be higher than the coupon rate. Yield to Maturity vs. Coupon Rate: What's the Difference? - Investopedia The yield to maturity (YTM) is an estimated rate of return. It assumes that the buyer of the bond will hold it until its maturity date, and will reinvest each interest payment at the same interest... Yield to Maturity Calculator | Calculate YTM The yield to maturity calculator (YTM calculator) is a handy tool for finding the rate of return that an investor can expect on a bond. As this metric is one of the most significant factors that can impact the bond price, it is essential for an investor to fully understand the YTM definition. ... In our example, Bond A has a coupon rate of 5% ... Yield to Maturity Calculator | Good Calculators Yield to Maturity: 8.54% Current Yield: 6.67% Reference The calculator uses the following formula to calculate the current yield of a bond: CY = C / P * 100, or CY = (B * CR / 100) / P Where: CY is the current yield, C is the periodic coupon payment, P is the price of a bond, B is the par value or face value of a bond, CR is the coupon rate.

Yield to Maturity (YTM) - Overview, Formula, and Importance Assume that there is a bond on the market priced at $850 and that the bond comes with a face value of $1,000 (a fairly common face value for bonds). On this bond, yearly coupons are $150. The coupon rate for the bond is 15% and the bond will reach maturity in 7 years. The formula for determining approximate YTM would look like below: Bond yield - Bogleheads The current yield formula is: Current Yield = Annual dollar coupon interest / Price. This formula does not take into account gains or losses if the bond was purchased at a discount or premium. [2] [3] For example: An 18-year, $1,000 par value, 6% coupon bond selling for $700.89 has a current yield of: 8.56% = $1,000 * 6% / $700.89. Zero Coupon Bond Yield - Formula (with Calculator) - finance formulas The formula for calculating the effective yield on a discount bond, or zero coupon bond, can be found by rearranging the present value of a zero coupon bond formula: This formula can be written as This formula will then become By subtracting 1 from the both sides, the result would be the formula shown at the top of the page. Return to Top Yield to Maturity (YTM) Approximation Formula - Finance Train P = Bond Price. C = the semi-annual coupon interest. N = number of semi-annual periods left to maturity. Let's take an example to understand how to use the formula. Let us find the yield-to-maturity of a 5 year 6% coupon bond that is currently priced at $850. The calculation of YTM is shown below: Note that the actual YTM in this example is 9 ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Yield to Maturity (YTM) - Meaning, Formula & Calculation - Scripbox Yield To Maturity (YTM) Formula Below is the YTM formula yield to maturity formula Where, bond price = the current price of the bond. Coupon = Multiple interests received during the investment horizon. These are reinvested back at a constant rate. Face value = The price of the bond set by the issuer. Yield to Maturity (YTM) Definition & Example | InvestingAnswers The yield to maturity is the percentage of the rate of return for a fixed-rate security should an investor hold onto the asset until maturity. The coupon rate is simply the amount of interest an investor will receive. Also known as nominal yield or the yield from the bond, the coupon rate doesn't change. Simply put, it is the total value of ... How to Calculate Yield to Maturity: 9 Steps (with Pictures) - wikiHow Once you have that information, plug it into the formula , where, P = the bond price, C = the coupon payment, i = the yield to maturity rate, M = the face value and n = the total number of coupon payments. [5] For example, suppose your purchased a $100 bond for $95.92 that pays a 5 percent interest rate every six months for 30 months.

Understanding Coupon Rate and Yield to Maturity of Bonds The Yield to Maturity is a rate of return that assumes that the buyer of the bond will hold the security until its maturity date and incorporates the rise or fall of market interest rates. This will be a bit technical. Let's see what happens to your bond when interest rates in the market move.

Difference Between Coupon Rate And Yield Of Maturity - Nirmal Bang The formula for calculating the yield of maturity of a bond is: YTM = { (Annual Interest Payment) + [ (Face Value - Current Trading Price) ÷ Remaining Years To Maturity]} ÷ [ (Face Value + Current Price) ÷ 2] Let's understand with the help of an example given below: An investor has a bond with a face value of RS 10,000 and a coupon rate of 10%.

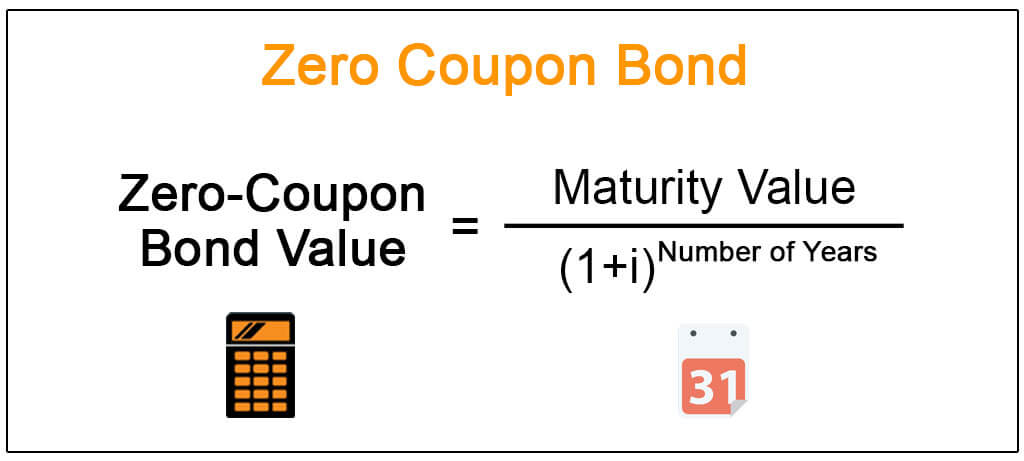

Zero-Coupon Bond: Formula and Calculator [Excel Template] To calculate the yield-to-maturity (YTM) on a zero-coupon bond, first divide the face value (FV) of the bond by the present value (PV). The result is then raised to the power of one divided by the number of compounding periods. Zero-Coupon Bond YTM Formula Yield-to-Maturity (YTM) = (FV / PV) ^ (1 / t) - 1 Zero-Coupon Bond Risks

Realized Compound Yield versus Yield to Maturity - Rate Return With a reinvestment rate equal to the 10% yield to maturity, the realized compound yield equals yield to maturity. But what if the reinvestment rate is not 10%? If the coupon can be invested at more than 10%, funds will grow to more than $1,210, and the realized compound return will exceed 10%. If the reinvestment rate is less than 10%, so will ...

When is a bond's coupon rate and yield to maturity the same? - Investopedia A bond's coupon rate is equal to its yield to maturity if its purchase price is equal to its par value. The par value of a bond is its face value, or the stated value of the bond at the time of...

Bond Yield to Maturity (YTM) Calculator - DQYDJ This makes calculating the yield to maturity of a zero coupon bond straight-forward: Let's take the following bond as an example: Current Price: $600 Par Value: $1000 Years to Maturity: 3 Annual Coupon Rate: 0% Coupon Frequency: 0x a Year Price = (Present Value / Face Value) ^ (1/n) - 1 = (1000 / 600) ^ (1 / 3) - 1= 1.6666... ^ (1/3) - 1 = 18.563%

Coupon vs Yield | Top 5 Differences (with Infographics) - WallStreetMojo What is Yield to Maturity? Yield to maturity is the effective rate of return of a bond at a particular point in time. On the basis of the coupon from the earlier example, suppose the annual coupon of the bond is $40. And the price of the bond is $1150, then the yield on the bond will be 3.5%. Coupon vs. Yield Infographic

What is the yield to maturity for a 3 year bond with a 10% annual ... A bond's yield is equal to its coupon when it trades at par. For the risk of lending money to the bond issuer, investors anticipate receiving a return equivalent to the coupon. Therefore the yield of maturity will be 10% itself , Option C is the right answer. To know more about Trading at par brainly.com/question/17266340 #SPJ1 Advertisement

Zero Coupon Bond Value Calculator: Calculate Price, Yield to Maturity ... Calculating Yield to Maturity on a Zero-coupon Bond YTM = (M/P) 1/n - 1 variable definitions: YTM = yield to maturity, as a decimal (multiply it by 100 to convert it to percent) M = maturity value P = price n = years until maturity Let's say a zero coupon bond is issued for $500 and will pay $1,000 at maturity in 30 years.

Yield to Maturity Questions and Answers | Homework.Study.com The yield to maturity (YTM) on 1-year zero-coupon bonds is 5% and the YTM on 2-year zeros is 6%. The yield to maturity on 2-year-maturity coupon bonds with coupon rates of 12% (paid annually) is 5.... View Answer. There is a 5.8 percent coupon bond with eleven years to maturity and a current price of $1,059.80.

Yield to Maturity vs Coupon Rate - Speck & Company Yield to Maturity (YTM) is the expected rate of return on a bond or fixed-rate security that is bought by an investor and held to maturity. Since bonds do not always trade at face value, YTM gives investors a method to calculate the yield they can expect to earn on a bond. Coupon rate is a fixed value in relation to the face value of a bond.

Yield to Maturity (YTM) - Definition, Formula, Calculations Yield to Maturity Formula = [C + (F-P)/n] / [ (F+P)/2] Where, C is the Coupon. F is the Face Value of the bond. P is the current market price. n will be the years to maturity. You are free to use this image on your website, templates, etc, Please provide us with an attribution link The formula below calculates the bond's present value.

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance.

:max_bytes(150000):strip_icc()/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Post a Comment for "40 yield to maturity of coupon bond"