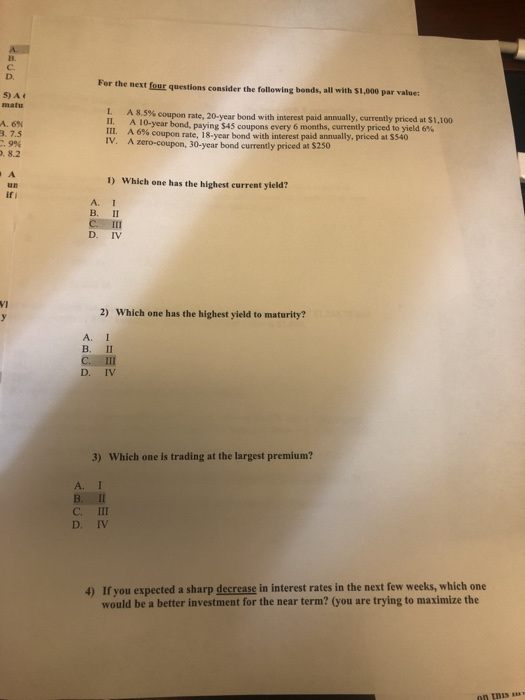

44 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest

Why Do Bond Prices Go Down When Interest Rates Rise? - The Balance Bonds compete against each other on the interest income they provide. When interest rates go up, new bonds come with a higher rate and provide more income. When rates go down, new bonds have a lower rate and aren't as tempting as older bonds. The bad news for bondholders is that fixed-rate bond issuers can't increase their rates to the same ... Coupon Rate - Learn How Coupon Rate Affects Bond Pricing If the issuer sells the bond for $1,000, then it is essentially offering investors a 20% return on their investment, or a one-year interest rate of 20%. $1,200 face value - $1,000 bond price = $200 return on investment when the bondholder is paid the face value amount at maturity. $200 = 20% return on the $1,000 purchase price.

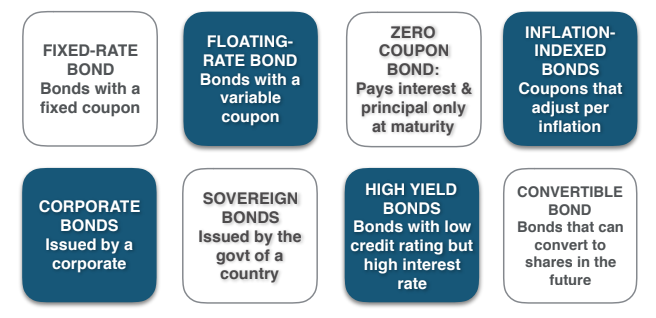

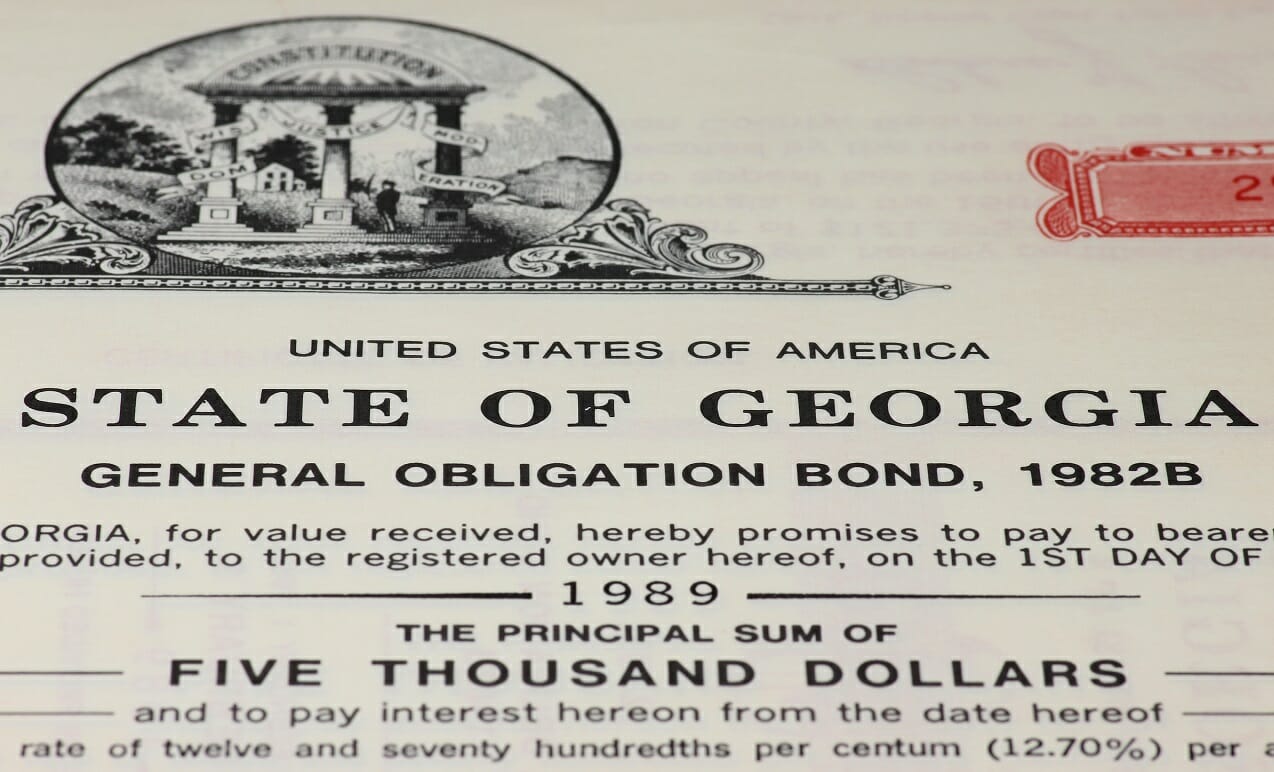

Coupon Bond - Guide, Examples, How Coupon Bonds Work A coupon bond is a type of bond that includes attached coupons and pays periodic (typically annual or semi-annual) interest payments during its lifetime and its par value at maturity. These bonds come with a coupon rate, which refers to the bond's yield at the date of issuance. Bonds that have higher coupon rates offer investors higher yields ...

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest

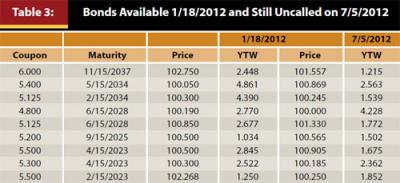

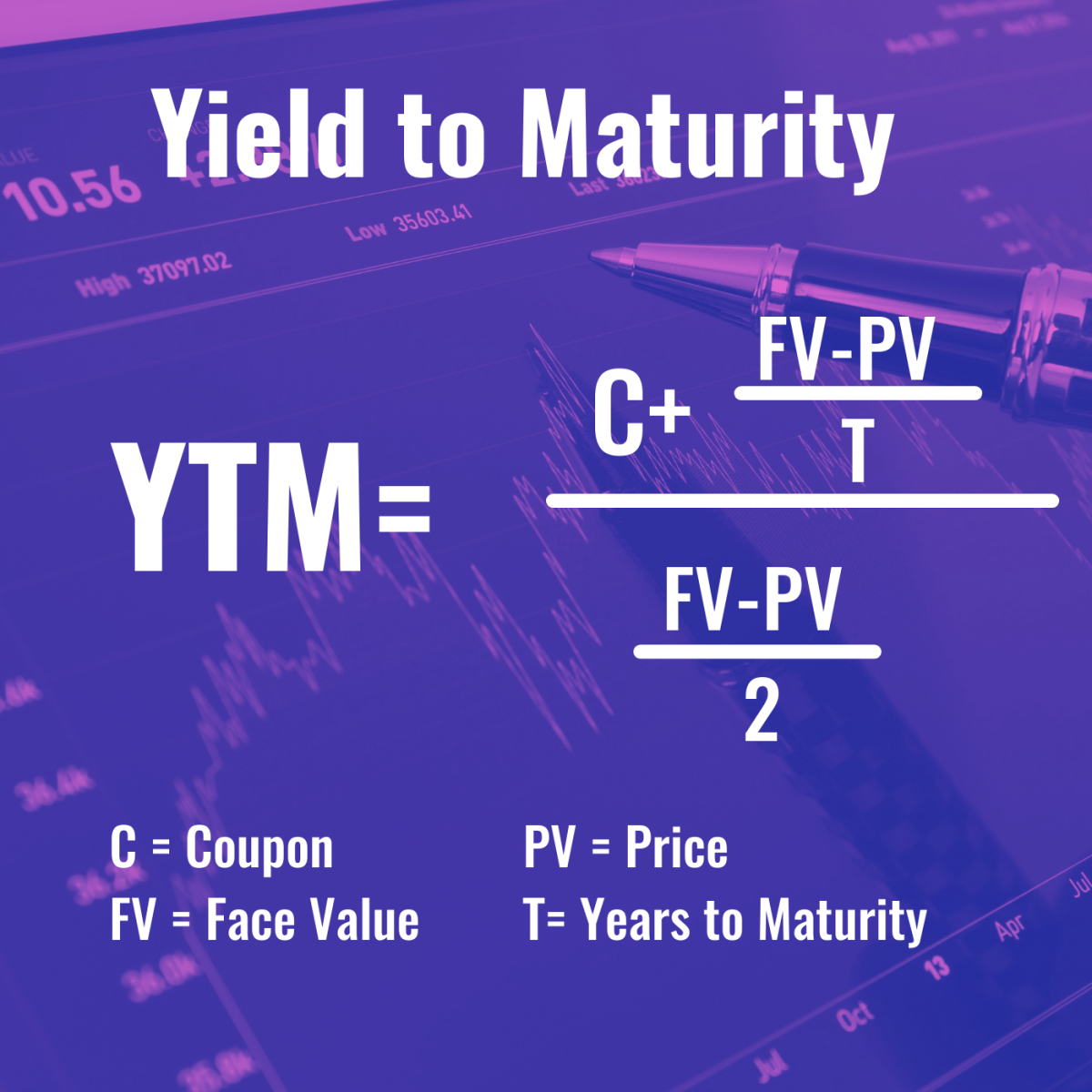

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010). Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet The yield on this bond is then 5.3%. Bond prices and yields have an intuitively inverse relation - when the price drops, the bond's yield increases and vice versa. If the XYZ bond is purchased when it's trading at 95 and held for a year, the investor can expect a return of 5.3%, which is higher than the initial 5% annual yield ... (Solved) - KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up ... 1 Answer to KNOWLEDGE CHECK ...

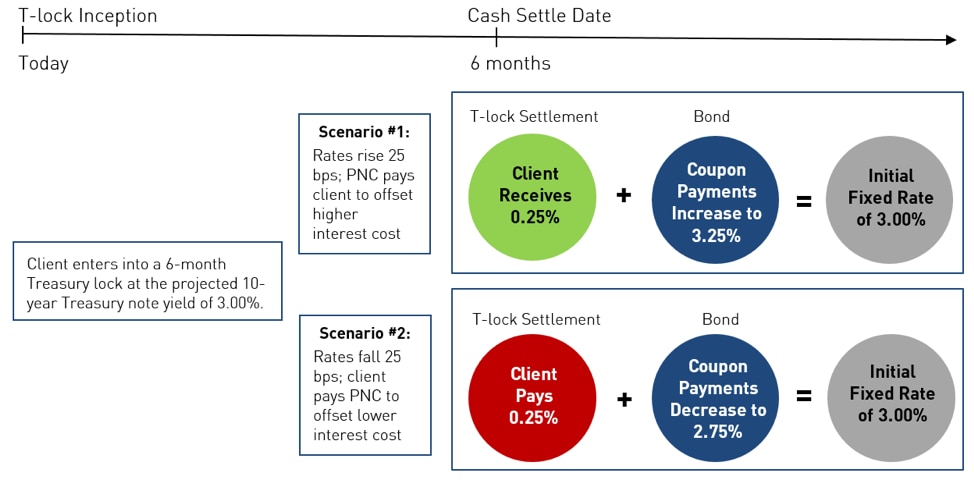

If the yield on a fixed coupon bond goes up does the borrower have to pay more interest. How Bonds Affect Mortgage Rates | Rocket Mortgage Bond prices have an inverse relationship with mortgage interest rates. As bond prices go up, mortgage interest rates go down and vice versa. This is because mortgage lenders tie their interest rates closely to Treasury bond rates. When bond interest rates are high, the bond is less valuable on the secondary market. 45 if the yield on a fixed coupon bond goes up does the borrower have ... 45 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest Bond Basics: How Interest Rates Affect Bond Yields When interest rates rise, prices of existing bonds tend to fall, even though the coupon rates remain constant: Yields go up. Conversely, when interest rates fall, prices of existing bonds tend to rise, their coupon remains constant - and yields go down. Quality matters. Not surprisingly, a bond's quality also has direct bearing on its price ... (Solved) - Fixed Income BMC module. When investors doubt the ... If the yield on a fixed-coupon ...

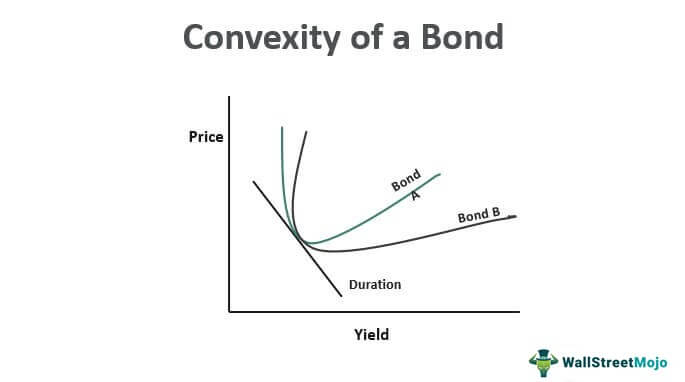

What Is Bond Yield? - Investopedia Bond Yield: A bond yield is the amount of return an investor realizes on a bond. Several types of bond yields exist, including nominal yield which is the interest paid divided by the face value of ... Bond Coupon Interest Rate: How It Affects Price - Investopedia A bond's coupon rate denotes the amount of annual interest paid by the bond's issuer to the bondholder. Set when a bond is issued, coupon interest rates are determined as a percentage of the bond ... If the yield on a fixed coupon bond goes up - AnswerData If the yield on a fixed-coupon 'bond goes up, does the borrower have to pay more interest? No, the price goes up. The yield goes up. Yes, the price goes down. The coupon payments go up. Yes, the price goes up. The yield goes down. No, the price goes down. The payments are fixed. Answer. Option d is the correct option No, the price goes down. Why Do Bond Prices and Yields Move in Opposite Directions? - The Balance Bond prices and yields move in opposite directions, which you may find confusing if you're new to bond investing. Bond prices and yields act like a seesaw: When bond yields go up, prices go down, and when bond yields go down, prices go up. 1. In other words, an upward change in the 10-year Treasury bond's yield from 2.2% to 2.6% is a negative ...

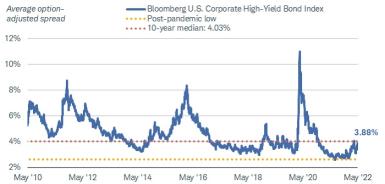

I Bonds Rates Increased To 9.62% (October 2022 Update) Using the formula below, we can determine the minimum rate an I Bond buyer would get starting in May 2022: Total rate = Fixed rate + 2 x Semiannual inflation rate + (Semiannual inflation rate X Fixed rate) Total rate = 0.000 + 2 x 4.81 + (4.81 x 0) Total rate = 9.62%. Earning 9.62% is a heck of a terrific deal! EOF Should I Invest in Bonds as Interest Rates Rise? - cnbc.com When interest rates rise, bond prices go down in value. Most bonds pay a fixed coupon (i.e. interest payment) and if rates go up, the only way a fixed coupon can equate to a higher interest rate ... (Solved) - KNOWLEDGE CHECK If the yield on a fixed-coupon bond goes up ... 1 Answer to KNOWLEDGE CHECK ...

Of coupons, yields, rates and spreads: What does it all mean? - YieldStreet The yield on this bond is then 5.3%. Bond prices and yields have an intuitively inverse relation - when the price drops, the bond's yield increases and vice versa. If the XYZ bond is purchased when it's trading at 95 and held for a year, the investor can expect a return of 5.3%, which is higher than the initial 5% annual yield ...

Basics Of Bonds - Maturity, Coupons And Yield - InCharge Debt Solutions Current yield is the bond's coupon yield divided by its market price. To calculate the current yield for a bond with a coupon yield of 4.5 percent trading at 103 ($1,030), divide 4.5 by 103 and multiply the total by 100. You get a current yield of 4.37 percent. Say you check the bond's price later and it's trading at 101 ($1,010).

/bond.asp_final-76c865e23abe4f6c9e7c41a38cfe6e39.png)

/bond.asp_final-76c865e23abe4f6c9e7c41a38cfe6e39.png)

/dotdash_Final_How_Are_Bond_Yields_Affected_by_Monetary_Policy_Nov_2020-01-9f04bd0397654170a7975ba70dc403a9.jpg)

Post a Comment for "44 if the yield on a fixed coupon bond goes up does the borrower have to pay more interest"